How CRM Benefits Insurance

The Challenges of Insurance

Changing Sales Models

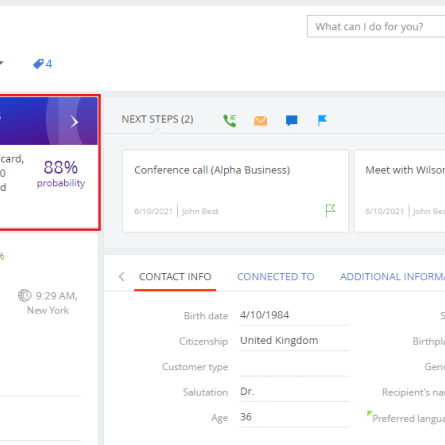

Insurance used to be a relationship/consultative sales model. Today, younger buyers are driving the need for a transactional sales model, especially for consumer insurance such as home or auto. This requires insurance companies to follow multiple sales models, which means multiple customer journeys, user experiences, and internal processes.

Dealing With an On-Demand Economy

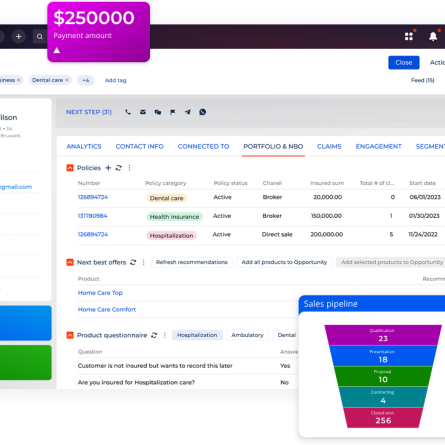

Customers want their information now and they want it available on their phones. This forces the insurance companies to offer online quoting, customer portals, and a suite of different products to adjust to consumer demands.

New Demographics of Buyer Persona

Today's buyers are looking for different products, such as pay-as-you-go auto insurance. This requires more detailed customer profiling and targeted digital marketing.

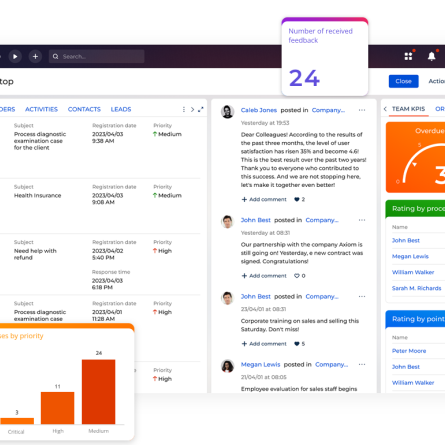

Talent to Replace Aging Salesforce

The insurance industry is facing a challenge with an aging workforce that is being replaced by a younger, tech-savvy workforce. CRM is a must for these younger workers who have a higher productivity rate through technology.

Market Competition

Insurance is creating more products than ever. To sell these products, companies need exact demographics for marketing. CRM with augmented data can provide companies the ability to target their customers with products that are right for them.

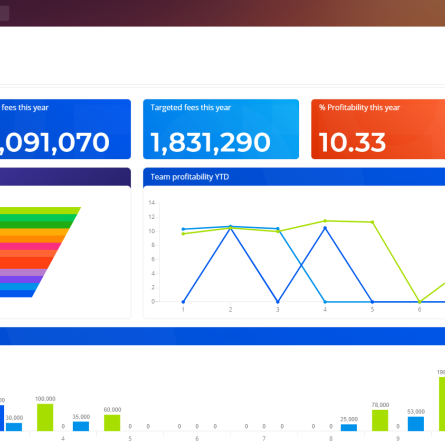

Data Analysis to Improve Customer Experience

Customer data analysis can provide insights into the buyer and help make inferences about behaviors, which can be included in the underwriting process to more accurately predict costs.

What Customers Say About Us

A Few of Our Insurance Customers

Equip Your Insurance Team for a Digital-First Future

From automation to advanced analytics, we’ll help you modernize your systems and meet rising customer expectations. Contact us today to get started.